Counting Carbon

"If you can't measure it, you can't manage it"

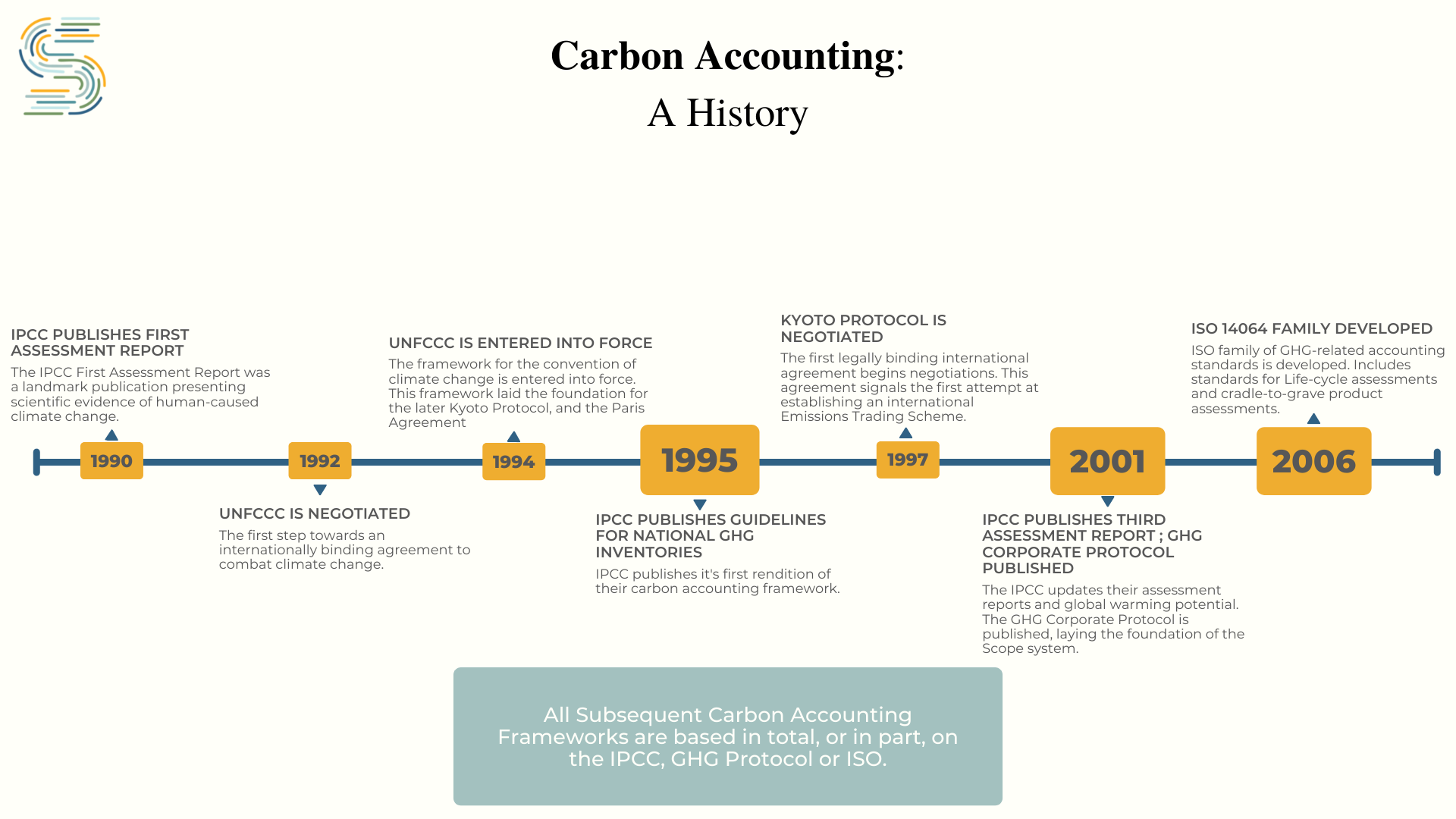

It has been clear since the turn of the millennium that greenhouse gas (GHG) emissions raise global temperatures, leading to deteriorating ecosystems, rising sea levels, the myriad downstream human, economic, national security, and geopolitical consequences of climate change. But how to measure the GHG emissions driving these outcomes is far less clear.

In recent years, various nations and international organizations have rolled out different initiatives to account for carbon emissions, but these systems rely on differing and sometimes incompatible mechanisms for measuring net GHG emissions. For example, should carbon content be measured from “gate to gate”, or at some point in the production process, or at a sector/industry/or individual product level? Who should be responsible for measuring the output: private companies, national governments, or non-governmental organizations? How should reported emissions be verified?

Because different approaches to carbon accounting can dramatically change the policy options that are suitable for achieving a given outcome, policymakers need to wrestle with these sorts of questions as they begin to design carbon accounting systems. But before delving into the details of various systems of carbon accounting, it’s important to understand the basics: what is carbon accounting, who uses it, and how does it help combat climate change?

What is carbon accounting?

At its most basic, carbon accounting is the process by which entities measure their GHG emissions in order to quantify their climate impact and set goals to limit emissions.

The main purpose of carbon accounting is to create a framework under which private and state actors can report their GHG emissions to a GHG program, the voluntary initiatives and regulatory programs that measure and compile GHG emissions reports. These programs require entities to report specific information to a GHG inventory for the purpose of helping set reduction targets, allocating carbon credits for an emissions trade scheme (ETS), permitting reasons, or just for public recognition. Each program operates in a slightly different manner, depending on the purpose of the accounting and reporting.

Who uses carbon accounting?

Many actors use carbon accounting frameworks, including private corporations, international organizations, and national governments. Each framework is tailored to the specific purposes of the actors. For example, the IPCC Guidelines for National GHG Inventories are targeted specifically at national government actors, whereas the GHG Corporate Protocol is tailored specifically for private corporations attempting to measure their emissions along a supply chain.

What are the main similarities and differences between accounting frameworks?

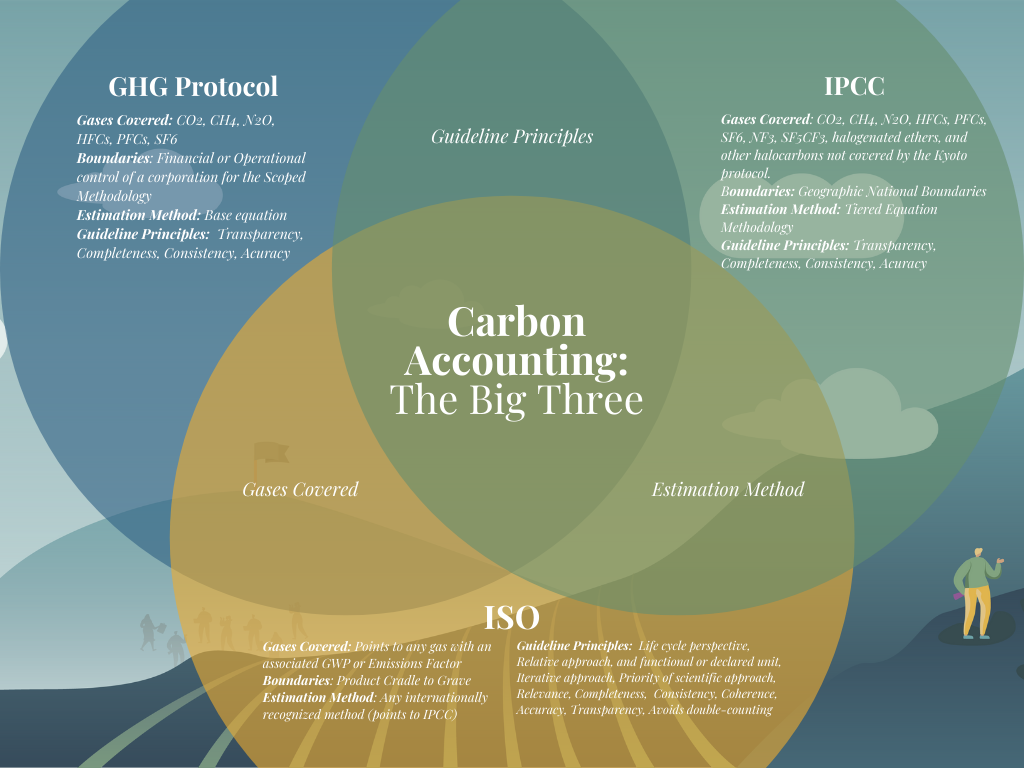

Today, the most prevalent accounting frameworks are the IPCC, the GHG Protocol Corporate Standard, and the International Standards Organization (ISO) 14060 family of standards—but there are tens, if not hundreds, of different carbon accounting frameworks and GHG programs that have been built off these frameworks.

The main difference between various carbon accounting frameworks is their aggregation level, or the level at which the GHG emissions are reported. In general, carbon accounting frameworks use one of four aggregation levels: product/project level, facility level, corporate level, and national level. Aside from aggregation level, accounting frameworks can differ in the type of gases covered, whether the program is voluntary or mandatory, the program type, and the type of emissions recorded (direct vs. indirect). Given the range of possible permutations for measurement, the lack of interoperability across frameworks can lead to “apples-to-oranges” comparisons, particularly when trying to measure the emissions content of similar products which use differing carbon accounting frameworks.

The below Venn diagram depicts how the GHG Protocol, IPCC, and ISO compare across their covered gases, boundary definitions, estimation method, and guideline principles. As the diagram shows, none are completely compatible with one another, with the IPCC and ISO only being similar in their estimation methods, while the GHG Protocol and the ISO cover the same gases. Meanwhile, the GHG Protocol and IPCC only overlap on their guideline principles.

Let’s pull this all together with an example.

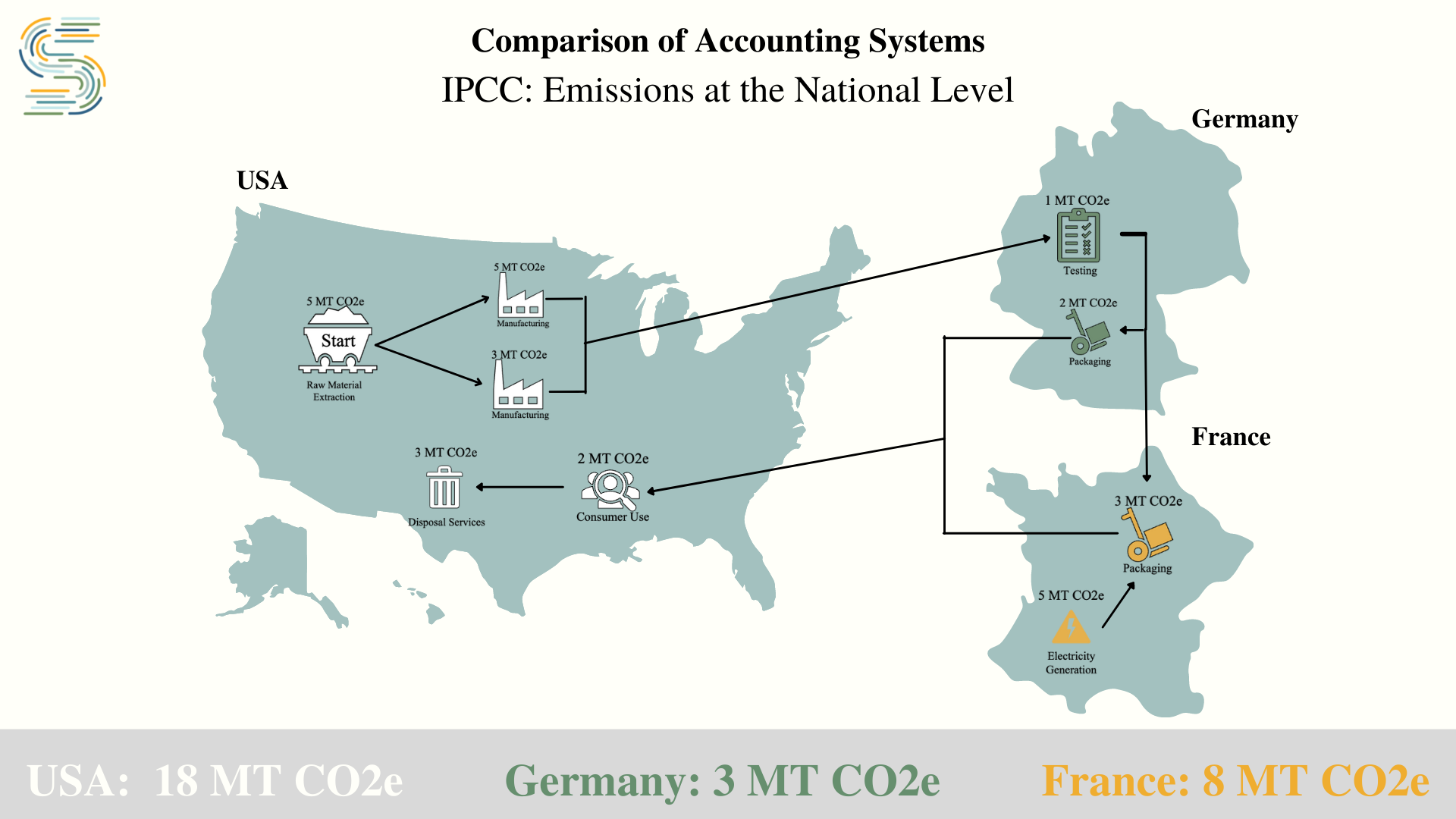

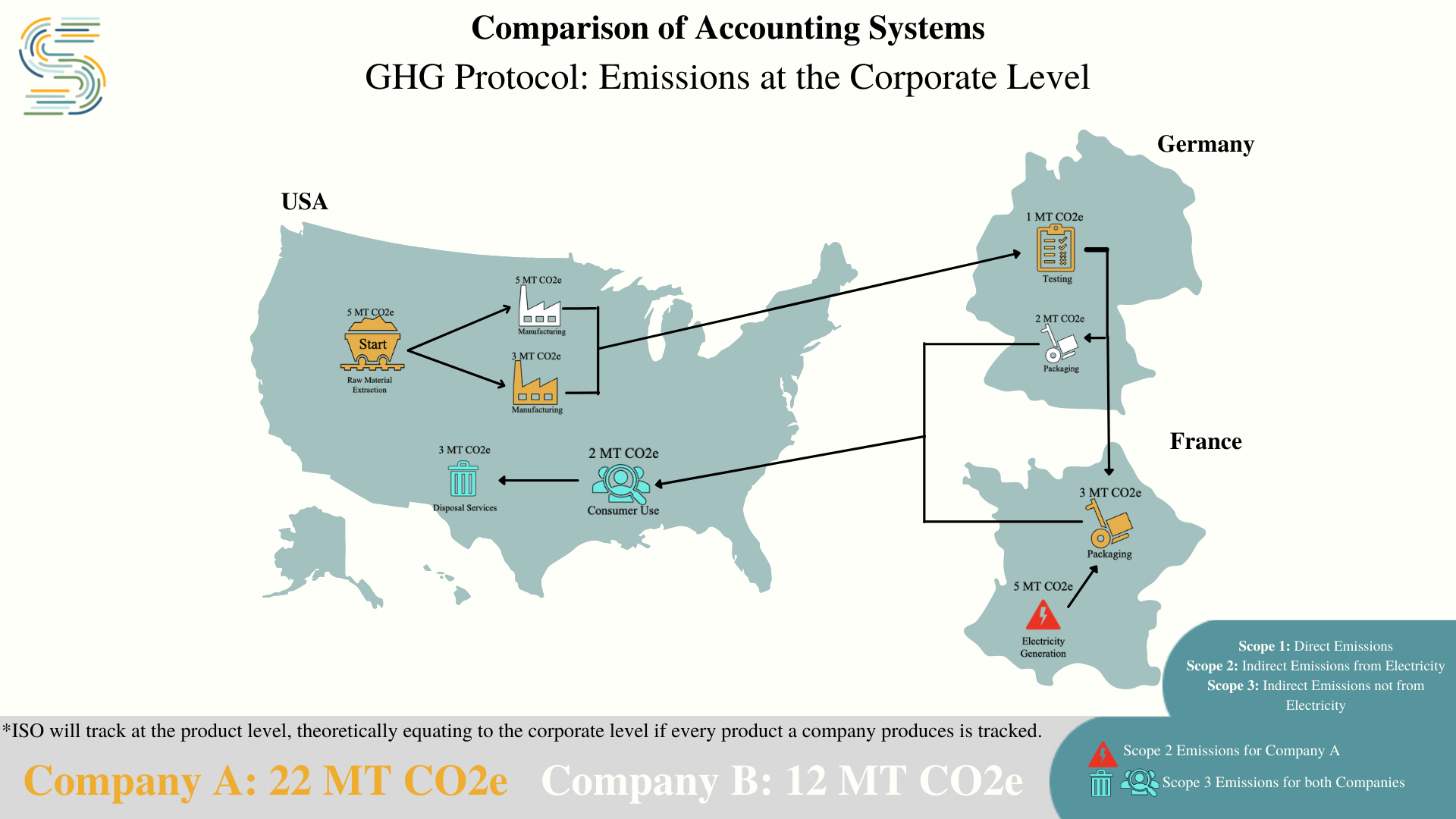

Let's follow a regular coffee cup as it moves along two separate but connected supply chains to understand how each framework would aggregate and then report those emissions to a GHG program or inventory. For the purposes of this example, we will specifically look at the carbon accounting principles employed by the IPCC Guidelines, the GHG Protocol Corporate Standard, and the EU-ETS.

Each of the above frameworks uses different boundary definitions for reporting emissions, and therefore aggregates at different levels:

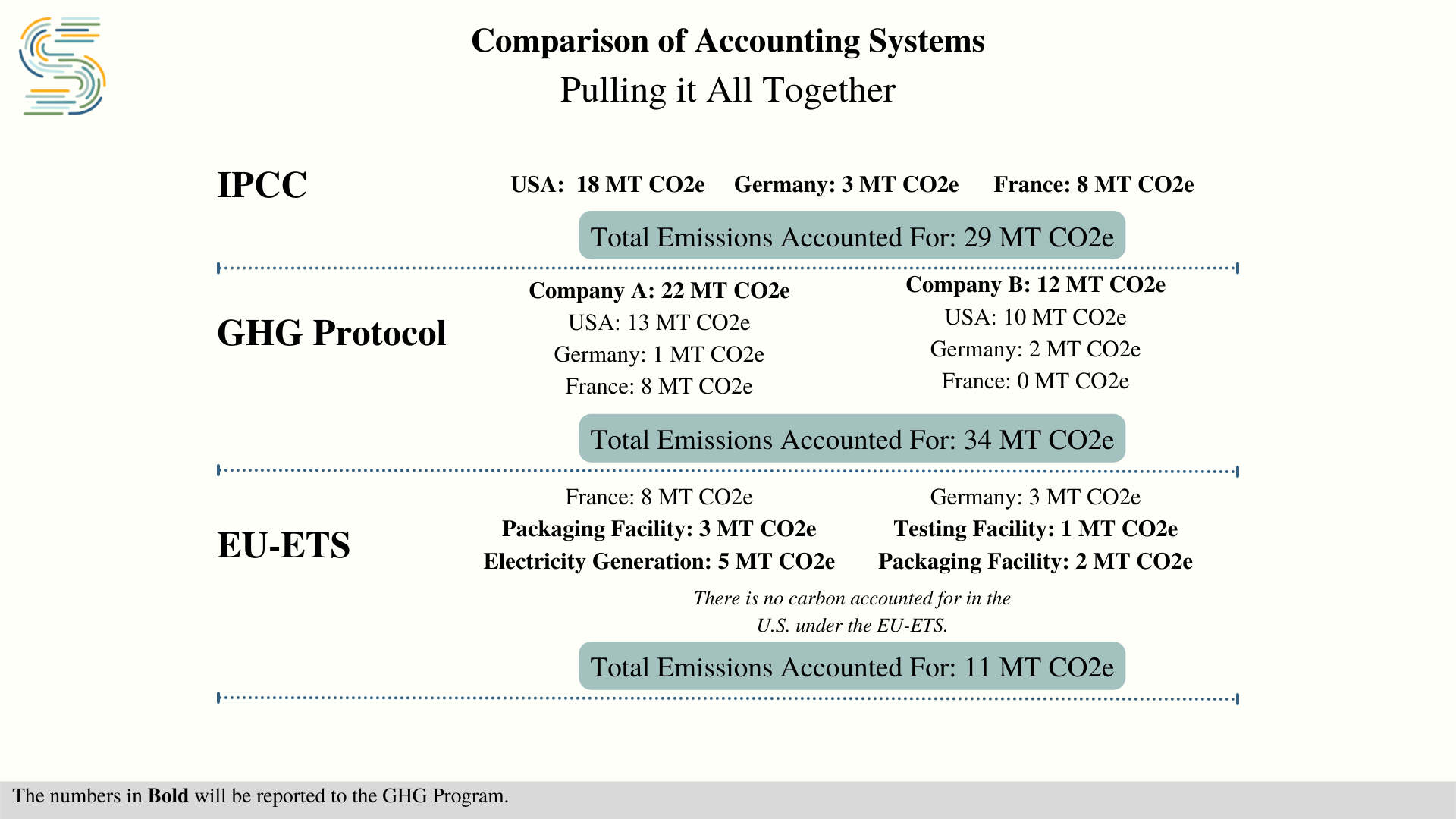

- IPCC Guidelines: Calculated at the national level. In this example, the emissions reported for the USA are 18 MT CO2e, where Germany is equal to 3 MT CO2e, and France is 8 MT CO2e.

- GHG Protocol: Calculated at the corporate level. The total Scope 1, 2 and 3 emissions for Company A in this example is equal to 22 MT CO2e, while Company Bs is 12 MT CO2e.

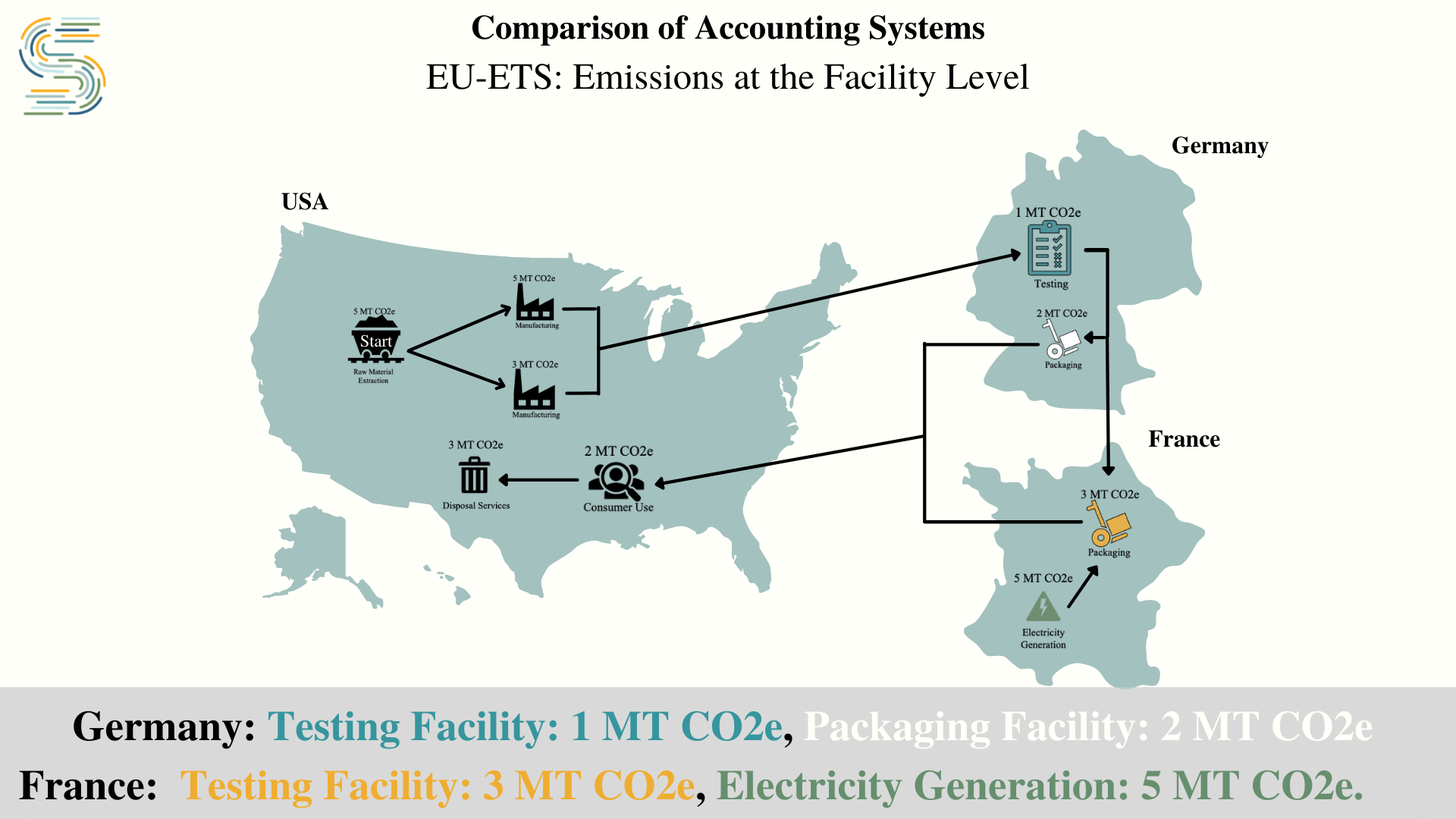

- EU-ETS: Calculated at the facility level. In this example, the reported emissions will be on a site by site basis. The testing facility will report 1 MT CO2e, while the packaging facilities will report 3 and 2 MT CO2e, for Companies A and B, respectively. The electricity generation site will also report its emissions of 5 MT CO2e.

Why do we care?

Carbon accounting is a fundamental tool for accurately calculating and comparing emissions across international borders. As a consequence, it is critical for setting the emissions reduction targets that will be necessary to achieve international climate goals and to design and monitor national or plurilateral carbon pricing or carbon trading systems.

As we can see above, the calculated output of emissions will vary greatly depending on the boundary definitions of the carbon accounting framework. Relying on the various permutations of carbon accounting systems as a basis for preventing carbon leakage will also lead to extreme difficulties in making apple-to-apples comparisons, potentially giving cover to protectionist motives and planting the seeds for trade disputes.

For this reason, understanding the frameworks is an absolutely essential precondition to crafting a national regime—whether that includes a carbon price, ETS, carbon border adjustment mechanism, or negotiations with other countries towards a plurilateral or multilateral solution.

Pillar

Eco²Sec