Border Carbon Measures: Decarbonizing Imports and Facilitating Green Trade

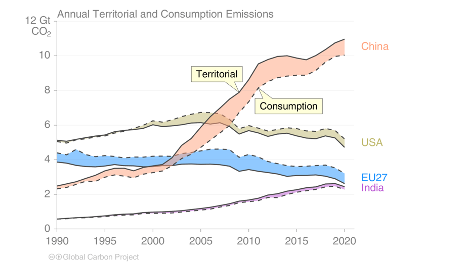

The United States and the European Union have adopted domestic laws and regulations over the past decade or more that are distinct in approach and have set both on a course toward decreasing domestic, or territorial, greenhouse gas (GHG) emissions. And while domestic emissions are decreasing, embedded emissions in imported goods, also called consumption emissions, may rise unabated. (Figure 1) For example, China generates GHG emissions when manufacturing steel, cars, or solar panels that are then imported and consumed, or used, in the U.S. and the EU. The global regime for domestic action on territorial GHGs is the UN Framework Convention on Climate Change (UNFCCC), the 2015 Paris Agreement, and the pledges made by countries to lower GHG emissions, also called Nationally Determined Contributions (NDC). However, there is no comparable global regime for traded goods, which creates a “carbon loophole” for the U.S. and EU to shift production and associated emissions to other countries without a net global emissions reduction.

Figure 1: Source: Global Carbon Project's 2022 release

Both the U.S. and the EU are on trajectories to decrease their domestic emissions, however, they also continue to point fingers at each other, largely disagreeing about their distinct approaches. The EU wants its domestically determined, economy-wide carbon price to apply to all imports. The U.S. is exploring more dynamic and sector-specific pricing based on relative emissions intensities between similar goods produced domestically and in exporting countries. The U.S. and the EU both aim to close the carbon loophole, but U.S. proposals also strive to facilitate lower emissions in traded goods by building bridges with developing countries. For example, one U.S. legislative proposal would create an international agreement option for emerging economies to be supported in net zero growth and not penalized for exports of higher carbon goods or left out of GHG-based trading metrics.

There is no need for like-minded countries to bicker about whose domestic legal framework will be copied into international trade law. Instead, countries should collaborate on innovating an interoperable, international GHG abatement framework for traded goods that operates smoothly with the various existing domestic GHG abatement approaches. Indeed, multilateral environmental and trade norms do not demand all countries to harmonize domestic approaches.

Countries can continue to craft domestic policies to incentivize domestic decarbonization. The analog complementary international trade policy would create different incentives focused on lowering emissions consumed through internationally traded goods. Taken together, countries are incentivized to support GHG reductions through sector-specific, head-to-head competition for the lowest GHG-emitting industries and energy sectors, thereby creating a new and effective market-based decarbonization regime.

Incentivizing the Decarbonization of Traded Goods

There are two main schools of thought on how to create incentives to push imports from high-emitting industries toward net-zero manufacturing, each with a unique set of pros and cons.

1. Economy-wide pricing of emissions (a.k.a. “carbon price”), which first emerged with emissions trading systems around 2003, is a system that imposes the same per ton carbon price on all industries and products.

The Pros:

- The simplicity of having one price.

- It is easier to compare prices with other nations that have domestic carbon prices.

The Cons:

- As an economy-wide metric, it fosters minimal product-to-product competition toward net zero manufacturing within each hard-to-abate sector.

- It is difficult to compare with nations that use other domestic approaches, such as those that require adherence to high environmental compliance standards.

- Limited to CO2 and not translatable to CO2-equivalent (CO2-e), which to date has meant non-carbon GHGs are rarely included. For example, short-lived climate super-pollutants (e.g., methane, fluorinated refrigerants like HFCs, etc.) are up to thousands of times more potent than CO2, which makes meaningful “carbon price” translation complicated to administer.

2. Sector-specific pricing of relative emissions intensities builds on the last 20+ years of experience, along with enhanced data collection, to impose a cost for GHGs embedded in imports specific to each product or sector. Formulating the cost based on the relative or comparative emissions means basing a border fee calculation on the difference between domestic production and imports of comparable products – i.e., country X sells steel made with 50% more emissions than country Y. This percentage difference is the basis for the import fee. This increases competition among manufacturers and countries to decrease import costs by decreasing GHG emissions.

The Pros:

- Maximizes market-based competition by having products and sectors compete directly for market share based on lower GHG production emissions.

- Incentivizes countries to compete for lower national average energy emissions to decrease national averages for sectors and products, thereby lowering import costs.

- Operates with any domestic GHG mitigation regime.

- Easily integrates all GHGs, including carbon and short-lived climate pollutants.

The Cons:

- It is new, so there is a learning curve for acceptance.

- Could be administratively burdensome for governments to collect and publish large volumes of data specific to emissions in each sector, but there is a fix for this challenge: Stop measuring every molecule.

Modern GHG Import Fee Policy Made Easy: Stop Measuring Every Molecule

If we can relieve the administrative burden, sector-specific pricing of relative emissions intensities is a superior approach that can be implemented globally and relatively quickly. Developing countries and small businesses would not need facility-level data to participate because a publicly available model can estimate product-level average GHG performance for all producers globally by product weight. Relative GHG intensities of the same product from different countries would then be the basis for the cost of a border fee. Such a model could serve as a global roadmap for the implementation of border fees.

What does a publicly available model with transparent methodology and outputs look like?

- It can be built using existing regulatory and production data from the United States (or other countries that already collect similarly granular levels of data) to model estimated emissions with common production methods and weather conditions. (see Data Modeling for Interoperable Product Carbon Accounting)

- It would make it possible to easily compare GHG performance and border fees along supply chains and allow countries to continue to enhance its accuracy by providing additional data when available.

- It reduces the data burden on developing countries and small and medium-sized businesses (SMEs) by eliminating the need for facility-level direct monitoring.

- Governments can guarantee transparency, fairness, and uniformity in measuring carbon in traded goods across borders.

The necessary data and expertise exist today within the U.S. government, thereby easily facilitating trade and commerce with small businesses and developing countries. Countries that dispute the findings of the model could remedy their claims by providing regulatory and production data, which would incentivize transparency while further enhancing the overall accuracy of the model.

The level of precision necessary to close the carbon loophole effectively and equitably cannot be achieved by having every exporting firm measure the GHG footprint of every assembly line, the approach promoted by advocates of facility-level Emissions Trading Schemes (ETS). That is because closing the carbon loophole by targeting consumed/imported emissions is a distinct policy objective from the extension of domestic carbon taxation to international competitors. Where Border Carbon Adjustment policies tied to an ETS seek to raise revenue and increase the costs of GHG-intensive production through a quasi-market-based government tax scheme, import-focused measures seek to level the playing field between the relative GHG performance of domestically produced products and imported goods, creating a de facto GHG performance standard for domestic consumption.

Trade policies can best incentivize emissions reductions when they complement, not duplicate, diverse domestic approaches to national decarbonization. Sector-specific pricing and options for simplified emissions accounting are both important policy design elements to achieve interoperability and inclusivity.

Photo Credit: iStock Robert Bodnar

Pillar

Eco²Sec