Governments Must Lead on Trade-Tailored GHG Accounting to Address “Carbon Leakage”

This week and next, countries around the globe are gathered in Egypt for Climate COP 27. It is increasingly clear that without trade policy solutions, the movement of goods across international borders, along with their respective carbon intensities, will continue to delay global decarbonization. This week the WTO released its report on Climate Change and International Trade. This blog explores how national governments can play a role in these solutions.

There are distinct global, national, and company level frameworks that seek to tackle climate challenges for different purposes. Some aim to quantify the emissions intensity of a company, others a nation, and still others of the entire globe. Existing approaches, however, are not specific to trade in goods, and therefore do not adequately address the emerging policy objective of curbing carbon leakage that results from companies moving production to countries that have less stringent greenhouse gas (GHG) emissions and environmental protection policies. To address carbon leakage and make “emissions offshoring” less attractive, governments must design national or global policies for the specific purpose of addressing embedded emissions in traded goods, which account for 25% of global annually.¹

Businesses around the world are grappling with a range of new requirements and schemes to measure their carbon footprint. From voluntary corporate accounting to mandatory reporting on measured emissions at facilities, the growing demands on industry can be head spinning, even for companies that are advocating for transparency. But these schemes are fit for a purpose other than measuring and addressing embedded emissions in traded goods, and businesses do not have the authorities needed to design and implement a trade regime that addresses consumption of embedded GHG content.

Nations across the map are struggling to find new ways to fulfill pledges to decrease carbon emissions to meet their Nationally Determined Contributions (NDCs) — or decarbonization targets — under the Paris Agreement, whether it is national strategies for energy, agriculture, or other sectors depending on their particular economic and industrial profile of emissions. NDCs include a range of measures to reduce and measure emissions. While some of the data may be relevant to embedded emissions in traded goods, the overall methodology is not a direct translation to measuring the carbon intensity of a product traded across national borders. In fact, using the same methodologies or inputs for different purposes could lead to double counting or undercounting.

International organizations and multilateral institutions are working in concert to set policies to reduce the global GHG footprint. While this network addresses some discrete aspects of the GHG footprints of goods traded across borders such as international shipping, gaps remain.²

National governments are uniquely positioned to design a GHG accounting scheme for traded goods. Let's take a look at how.

GHG accounting — or the process of measuring GHG emissions — is a foundational tool for understanding the carbon intensity of any manufacturing or industrial process of a traded good.

Although GHG accounting systems share a common goal — to measure the volume of carbon emissions — they often differ with regard to the particular mechanisms and approaches that they use to measure net GHG emissions. GHG measurements can quantify carbon intensity at the level of individual products or projects; or aggregate emissions at the level of facilities, firms, or even entire sectors. GHG accounting frameworks also differ with respect to the types of gasses covered, whether the program is voluntary or mandatory, and the type of emissions recorded (i.e. direct vs. indirect). As noted above, depending on the entity counting the carbon (business, national government, international regime), what is counted and how it is counted differs depending on the objective.

A climate-related trade policy that imposes a tax or tariff on traded goods based on relative emissions content will require a GHG accounting formula for trade in order to ensure an apples (domestic products) to apples (the equivalent imported products) comparison. This means the policy must be able to calculate the embedded GHG emissions of imported products that may undergo multiple production processes in multiple countries before reaching the U.S. border, and then compare the resulting figure to equivalent domestic goods with the aim of addressing the delta in emissions through a tax or tariff that accounts for the relatively higher emissions and relatively lower costs of production. This is inherently a government role.

Here are four ways that the role of government could be used to design a transparent, fair, and durable system of measuring embedded emissions for purposes of trade.

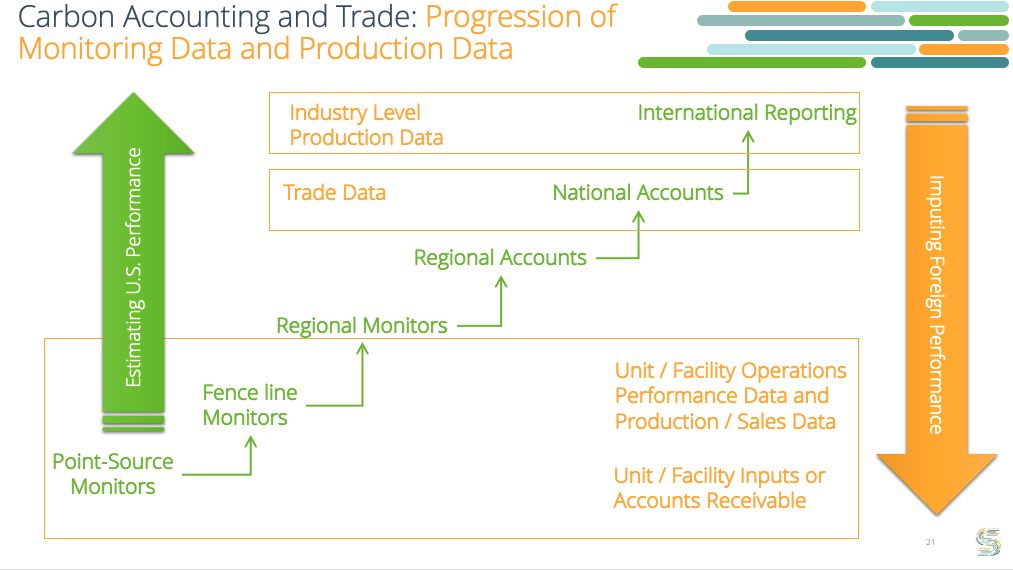

1. Governments Can Aggregate Entity/Facility-Specific Emissions Data to Create National Averages

While emissions are specific to goods produced by businesses, using the actual facility-level values as a basis for a GHG accounting scheme for domestic and traded goods may compromise business proprietary data and be difficult to scale globally. Instead, governments can aggregate facility-level data reporting to impute national GHG intensity averages by sector – both domestically and for other countries. This not only protects business proprietary information, but also provides a solid foundation for making an apples-to-apples comparison because it would be done on a sectoral basis (e.g., steel, aluminum).

A system of national averages also creates an incentive within each sector to have the lowest emitters in the sector pushing on the highest emitters to bring the average down and thereby increase the delta and resulting carbon tariff liability of imports. Finally, national averages are critical to ensuring that sectoral production is not bifurcated to serve domestic and export markets to avoid tariffs while doing little to advance sector-wide decarbonization. (Note: Some sectors may need to be broken down into sub-sectors for this to have maximum impact.)

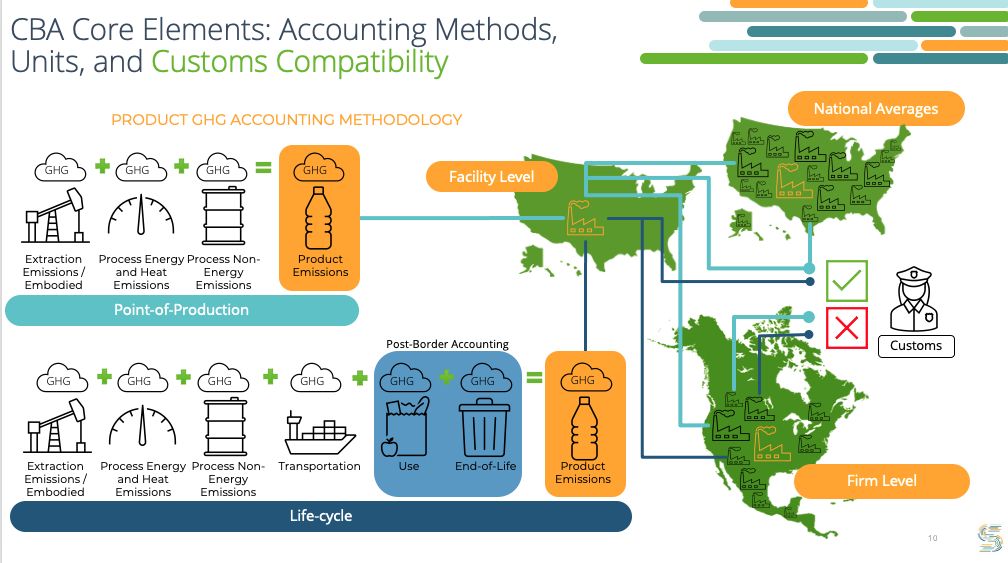

2. Governments Can Design a Point of Production GHG Accounting Scheme for Traded Goods to Align with the International Trading System

Unlike the life cycle GHG accounting systems adopted by many businesses that track emissions through end use and include emissions from electricity to power corporate office buildings, a GHG accounting system for trade should be specific to the points of production of a particular good so that embedded emissions from domestic and imported goods can be properly compared without overcounting emissions that go “beyond the border” for trade (e.g., consumer use, end-of-life).

In a point of production system, emissions can be measured and assigned a national average at each point of production – including when the production or transformations of a product occurs in multiple countries. Each “point of production” could then be aligned with a product code in the Harmonized System, a globally recognized and longstanding system that is the foundation for the international trade regime.

Thus, when an imported good enters the United States, for example, it would be possible to view its “emissions passport.” By knowing where each of point of production occurred, the HS code for that point of production, and the national average for emissions associated with that point of production, customs officials at the border could roll up the tariff rates for each point of production into a final carbon tariff.

This may sound complex, but it is simply an outgrowth of the international trading system that we are already using every day and that all countries are well familiar with. It is also critical that all points of production are traced – a value chain approach that includes upstream processes – otherwise there is room for additional carbon leakage. For example, if a company in Country A (low carbon intensity) purchases steel from Country B (high carbon intensity) to make a product and export to Country C that has a carbon tariff, Country C will only see that the product is coming from Country A and a low tariff will be assigned. A point of production approach closes this loophole by ensuring that Country C knows the steel input came from Country B.

3. Governments Can Mandate Reporting to Fill Data Gaps

With a point of production approach to GHG accounting, the question still remains as to what the source of emissions data should be. Few countries have comprehensive, publicly available national databases of GHG emissions by sector. And not all facilities in all sectors in all countries are mandated to report GHG emissions, let alone in a harmonized way. As a result, governments – alone or in coordination – will need to look at ways to leverage existing data requirements and fill data gaps, ideally without creating a significantly heavier burden for businesses.

One promising path that should be explored relates to the already widespread collection of data to measure NOx and SOx pollution. Many countries already have the authorities and reporting structures in place to measure and collect this data. The emissions data measured onsite at facilities (i.e., gate-to-gate accounting) could be used as a proxy for carbon intensity, since calculation of the NOx and SOx data requires reporting facilities to also know their carbon emissions. In the absence of a globally recognized method of GHG accounting, this type of solution offers one of the best short-term paths to being able to accurately compare emissions across countries.

Many countries have also already modeled their energy sectors’ carbon intensity in support of their NDC. The readily available data points would give you the GHG intensity from energy used and fugitive emissions in the transformation of a product. Countries that do maintain more comprehensive and transparent databases of GHG emissions — including the United States, the European Union, and several others — should move quickly to compare data points to understand interoperability of systems for purposes of trade, and where gaps remain. With the EU already moving forward towards its own carbon border adjustment mechanism based on domestic carbon prices, such an exercise would help the EU to better understand that U.S. carbon intensity in many sectors is as good as or even better than that in the EU and that the absence of a U.S. carbon price should not be determinative of how U.S. exports are treated at the EU border.

The US and EU could also be working with other countries in fora such as the WTO to look at how governments can move towards more comparability of GHG accounting methods and data for purposes of trade with the aim of decarbonizing global supply chains.

In the longer term, countries could adopt new legislation or regulatory frameworks to fill data gaps or modify existing data collection methods to enable measurement of embedded GHG for purposes of trade. For example, the recently enacted U.S. Inflation Reduction Act included federal funding for the purchase of relatively low-cost emissions sensors that measure emissions at a point of production in real time. Similar policies in other countries and foreign assistance to distribute these tools could help make gate-to-gate GHG accounting technologies more affordable and available globally.

4. Governments Can Support Transparency Efforts

National GHG emissions data in some countries is regularly updated and publicly available. In the United State this information from point source measurements and fenceline monitors can be found on EPA’s Facility Level Information on Green House gases Tool (FLIGHT). Canada also published facility level reported GHG data annually. Transparent tools like these with regularly updated recent emissions performance data can be rolled up into national averages by sectors or products without segregating manufacturing for export from manufacturing for domestic consumption. This will address the current phenomenon of certain firms or facilities using carbon efficient manufacturing methodologies only for export and using more carbon-intensive practices for local consumption.

Not all countries currently have facility level data collected and available publicly. Where carbon border adjustment policies are implemented, proxies could be used while governments work to enhance data collection and publication. For example, if the United States imputed an emissions-related tariff based on best available data from regional monitors, international reporting or other sources like NOx and SOx reporting, those countries’ governments would be incentivized to engage in better data collection or to increase transparency of sectoral emissions to reduce tariff liability.

The United States should lead on developing a climate-focused trade policy that facilitates global decarbonization and stems carbon leakage in a fair, transparent, and balanced way – beginning with actions to ensure an apples-to-apples comparison of domestic and imported emissions for traded goods.

Here are 5 early steps to take:

- Establish an interagency expert task force on trade-specific climate measures for carbon intensive sectors (i.e. Customs, EPA, DOE, Treasury, Commerce, State Department, USTR, etc.) and establish an ongoing mechanism for industry and stakeholder input and ideas exchange.

- Inventory all public and business confidential data already being collected by the U.S. government that could support a GHG accounting methodology for traded goods.

- Identify and address gaps in data with legislation, regulations, or rules for additional data collection or enhanced compilation.

- Compare trading partners’ available data sets in order to understand where there are data gaps that will make an apples-to-apples measurement of embedded emissions challenging, develop a suite of options to address those gaps, and identify countries that have similar data sets and who may be potential club partners.

- Map the data for products or sectors to the Harmonized System so that a tariff model can be easily replicated by other countries (facilitating “club” options for like-performance and favored status for least-developed countries to be supported in decarbonization of traded goods).

These foundational steps to equalize data inputs and open the right lines of communication will enable governments and businesses to identify administrable and scalable policies to address trade-related GHG leakage.

The United States has an opportunity to lead as a first mover and design smart, scalable policies that will turn our high level of environmental standards into a carbon advantage, while working with partners around the globe to address the critical issue of carbon leakage.

Lauren Stowe is Silverado Policy Accelerator's senior climate policy advisor.

NOTES

1. ICAO is funded and directed by 193 national governments to support their diplomacy and cooperation in air transport as signatory states to the Chicago Convention (1944).

2. In February 2020, Edgar Hertwich asserted that approximately 10% of global emissions were associated with the production of products imported for export production.

Pillar

Eco²Sec